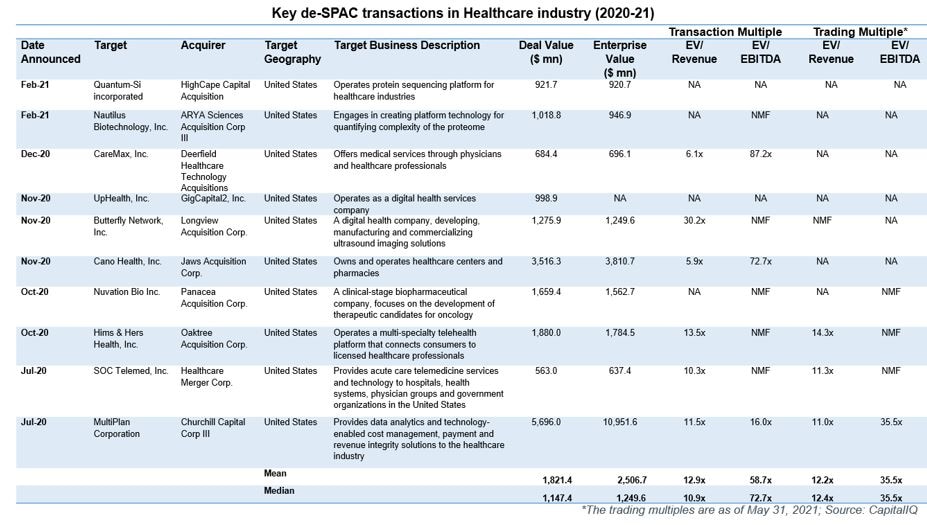

If the transaction is not approved, 100% of the trust proceeds, plus accrued interest, are returned to the investors, and investors have the right to redeem their own shares for cash at the time of the De-SPAC Transaction. SPAC investors have limited downside exposure given that investors are entitled to vote to approve or disapprove the De-SPAC Transaction.SPACs have a wide range of potential investors, including retail investors, who otherwise may not have access to the management teams of a SPAC or the investment opportunities that SPACs target.

The IPO proceeds are held in a trust for up to a defined period of time for the purpose of acquiring a private business, known as the “De-SPAC Transaction”. A SPAC is a company, with no initial assets or operations, that raises capital through an initial public offering (“IPO”).

PIPE IN SPAC TRANSACTION PDF

For a PDF of the memo, please click here.

0 kommentar(er)

0 kommentar(er)